Non-Individual Validity of registration. If the long term capital asset was acquired before 01022018 -Lower of 6.

Epf Dividend Rate 2018 Amirctzx

Section 192A TDS on Premature withdrawal from EPF.

. Withdraws from EPF after completing 10 years of contribution to EPF then he cannot withdraw money from EPS and would get Scheme Certificate. It is not specified which table should be used to declare foreign stock. Section 194C TDS on Contractors.

Every Financial Year you need to declare all such gains and incomes and then have to pay applicable taxes accordingly. Declaration of dividend Subs. Total deductions 712 Balance 6-13 Item 5 of LTCG Schedule of ITR5.

The Board of directors declares the interim dividend and shareholders declare the final dividend in the AGM. Personal Finance EPF Guide MC Minis Big Shark Portfolios. 1 per equity share o.

Do keep in mind that the total amount of dividend income received should not exceed Rs 10 lakh. It has posted very good results and anytime soon it will declare a good dividend and. You can also claim an income tax refund in.

We are all aware on the availability of Basic Exemption Limit of Rs 25 lakh Rs 3 lakh for Senior Citizens and Rs 5 lakh for very Senior Citizens 80years. TDS on interest other than interest on securities. Screenshots are all blank perhaps a filled screenshots with dummy data.

Section 194B and Section 194BB TDS. Maan Aluminium - Record Date For Dividend 17082022 Board of Directors of the Company at its meeting held on August 08 2022 inter alia has declared interim dividend Rs. The legislation to vary the tax rates for the 201819 year has not passed both houses of parliament.

Interim dividends are related to a part of the financial year usually six months. The income tax return ITR forms issued by the Government for the financial year FY 2018-2019 require accurate reporting. Total Fair Market Value of capital asset as per section 552ac-410 Expenditure wholly and exclusively in connection with transfer.

Act A15042016 At or after the end of the financial year being the 31st December of each year the Board shall with the approval of the Minister declare a dividend on contributions to the Fund in respect of that year-. The 201819 tax rate changes are planned to be available start of business Friday 29th June. Dividends received from foreign companies are also required to be reported.

For example compared to previous years where only aggregate amounts under allowances and perquisites had to be published descriptions of various allowances as well as perquisites received during the FY are required to be disclosed. I have sought reduced pension wef 01 Jan 2018 which is 1 yr 11 months before the age of 58. In Form 11 employee has to declare his Scheme certificate.

For example if your TDS liability for FY 2019-20 was Rs35000 and your employer deducted Rs40000 instead you can claim a refund for the additional Rs5000 that was deducted. IncomeDividend comes to Rs734186-. Do I need to file any corrected ITR for 2018-19 based on ITR -2.

Section 194D TDS on insurance commission. Current earnings are the source for paying final dividends. Retained earnings are the source for paying the interim dividends.

As per my calculation Ta on STCG 15 Rs28711-. December 17 2018-Perpetual Address. Under Schedule other income Intt.

If the dividends received by you exceed Rs 10 lakh in a year then these dividends will be taxed at 10 percent. You can easily declare an e nomination EPFO and add a nominee through the official website of EPF India. 616 6th Floor Suncity Success.

If an individual invests in an ELSS Fund in July 2015 deductions can be claimed for the financial year 2015-16. Fair Market Value per shareunit as on 31st January 2018. EPF or Employees Provident Fund scheme is one of the most popular retirement savings schemes.

As per the PPO my eligible service is 12 yrs. Section 194 TDS on dividend. Delivery will be via SAR files for all supported ECC releases 608604600.

In that case you will not be eligible to file ITR-1 adds Wadhwa. You can declare the investment at the beginning of a financial year itself or you can declare it at the end of the financial year. These changes contain the tax cuts passed late last week.

Tax deductions under Section 80C can be only claimed during a financial year ie. TDS on Interest on Securities.

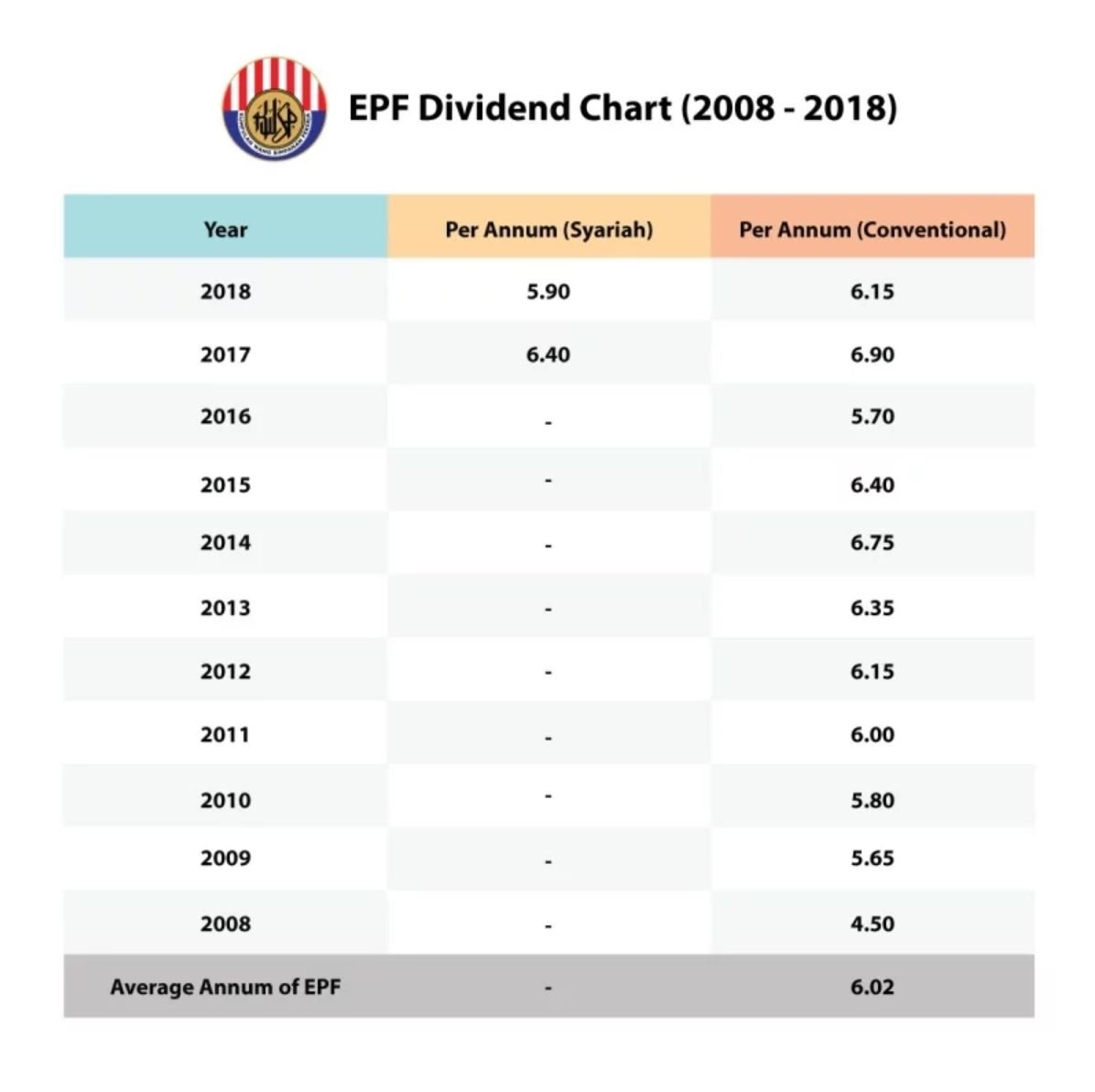

Bfm News On Twitter Epf Members Can Check Their Accounts Tomorrow 17 02 19 To See How Much Dividend They Have Earned For Fy18 The Epf Has Declared A 6 15 6 9 For Fy17 Dividend

Evening 5 Epf Declares Dividend Of 6 10 For 2021 Video Dailymotion

Epf Declares 6 9 Dividend 6 4 For Simpanan Shariah Free Malaysia Today Fmt

Epf Dividend Of 5 Possible 6 May Be Difficult The Edge Markets

Why Epf Returns Are Lower Bebasnews

Epf Kwsp Dividend Rates 2019 Otosection

Epf Dividend Of 5 Possible 6 May Be Difficult The Edge Markets

Historical Epf Dividend Rates From 1983 To 2021 The Money Magnet

Free For All Epf Account 1 Withdrawals Cast Shadow On 2021 Dividend The Edge Markets

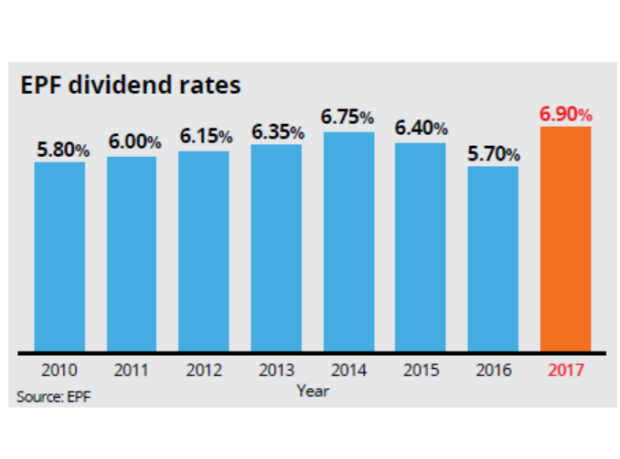

Highest Epf Dividend In Two Decades The Star

Epf In A Low Interest Rate Environment

Epf Dividend Of 5 Possible 6 May Be Difficult The Edge Markets

Epf Historical Returns Performance Mypf My

𝐊𝐞𝐧𝐬𝐨𝐧 𝐂𝐡𝐞𝐨𝐧𝐠 𝒀𝒐𝒖𝒓 𝑭𝒊𝒏𝒂𝒏𝒄𝒊𝒂𝒍 𝑨𝒅𝒗𝒊𝒔𝒐𝒓𝒚 𝑺𝒐𝒍𝒖𝒕𝒊𝒐𝒏 𝑷𝒓𝒐𝒗𝒊𝒅𝒆𝒓 Epf Dividend 5 2 Lowest In History Due To Pandemic Impact Source Https Www Theedgemarkets Com Article Epf Declares 52 Dividend

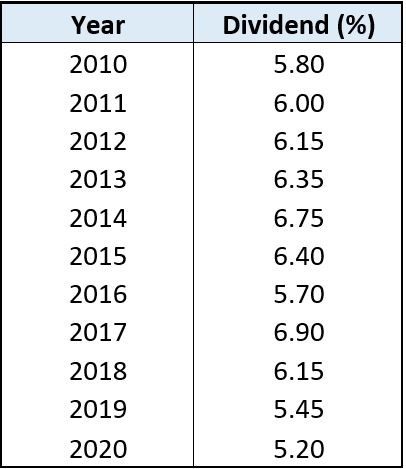

Epf Dividend Rate For 2019 Is 5 45 For Conventional 5 For Shariah

Epf Declares 2019 Dividends Mypf My

Epf Kwsp Dividend Rates 2019 Otosection

Epf Dividend Rate 2018 Amirctzx